Zoopla’s latest Quarterly report makes for very interesting reading from a Landlord’s perspective.

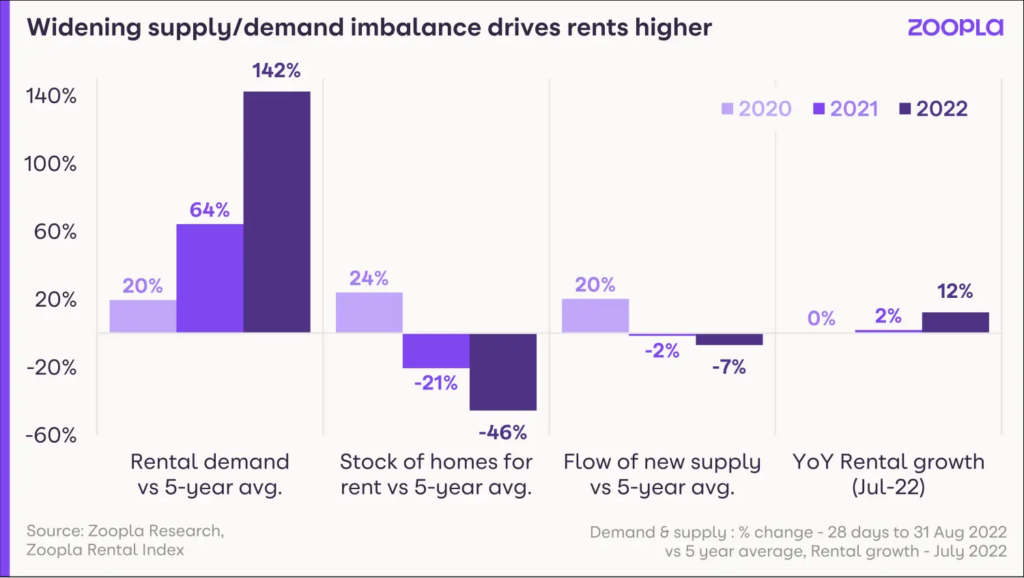

As you can see from the chart below, the gap between supply and demand for rental properties is widening and this is causing the continual increase in rental prices.

Demand has increased massively again this year, which follows on from what we were seeing at the back end of 2021 as detailed in our December blog post. At Excel, we have seen more Japanese Corporate Tenants coming to London along with the return of overseas students on a larger scale, which always drives up prices and demand.

Conversely though, the available rental stock has dropped dramatically in that same period, with the average level falling by 46% against the 5 year average in the last 12 months.

We have seen a number of Landlords selling their rental investments as well as a larger amount of tenants opting to renew, rather than move to larger properties, which all contributes to the lack of available houses and apartments on the market.

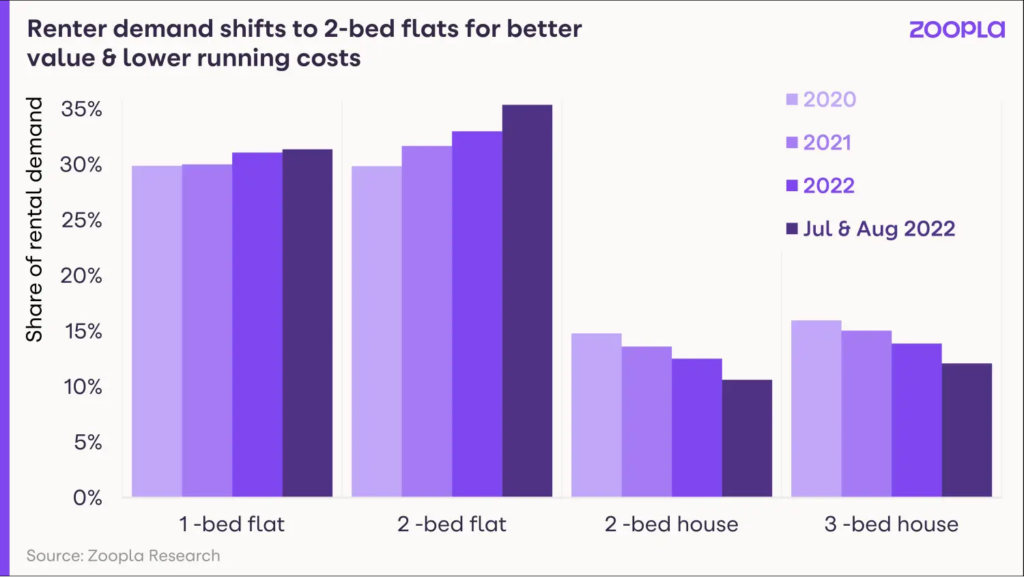

The cost of living crisis, with high inflation and colossal energy costs have also meant that some tenants are staying put in 1 and 2 bedroom apartments, rather than making the natural progression to larger properties when their family size increases.

The chart below demonstrates this shift in the overall share of rental demand between the different types of property:

This is a really good time for Landlords with studio, 1 bed and 2 bedroom properties to be bringing them to the rental market. This level will likely continue for the next Quarter but it isn’t sustainable long term, so now really is the time to make the most of your rental investment.

BREAKING NEWS

At the time of writing this, the Government has made announcements as part of the “mini-budget” relating to the property industry.

It has been announced that they have introduced a cut to stamp duty, with the threshold at which the tax falls due being raised to £250,000 from its current £125,000 level.

At the same time, the threshold for first-time buyers has been increased from £300,000 to £425,000.

The chancellor also increased the value of the property on which first-time buyers can claim stamp duty relief from £500,000 to £625,000.

—

Please don’t hesitate to contact us if you’re considering renting out your property to find out if it you can take advantage of our specialist, in-house Japanese Corporate Desk.