– 03 Jan 2020 –

A new decade has begun, an ideal time to look back at the housing market over the past 10 years.

- In England and Wales, the average price of a property has risen by £72,000 over the past decade. Across the South East, South West and London, average property prices have increased by over £100,000. All but one region have seen double digit house price growth.

- Official figures indicate 30% of dwellings are now rented privately from registered providers or with a job or business. This equates to an extra 1.3 million dwellings compared to a decade ago.

- Changing demographics and family structures have seen the number of households rise at a higher rate than the population since 2010, a trend that looks set to continue. What will the next decade hold? Only time will tell.

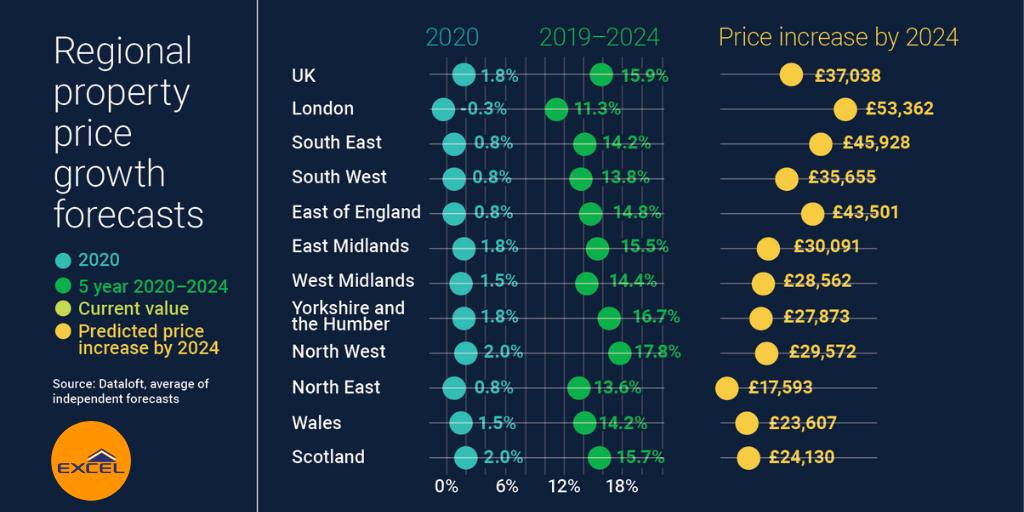

Regional property price growth forecasts

- An average of independent forecasts predicts the average price of a property will rise by 1.8% over 2020 and 15.9%, cumulatively, over the next five years, an increase in purchase price of just over £37,000.

- With predicted growth of 2%, Scotland and the North West are anticipated to experience the fastest rate of price growth over 2020.

- Over the next five years all regions of the UK are anticipated to witness double digit price growth, the North West and Yorkshire and the Humber leading the pack.

- Despite predictions that cumulative growth across the capital will be below that of other regions, the average price of a property across London looks set to rise by over £50,000 over the next four years.

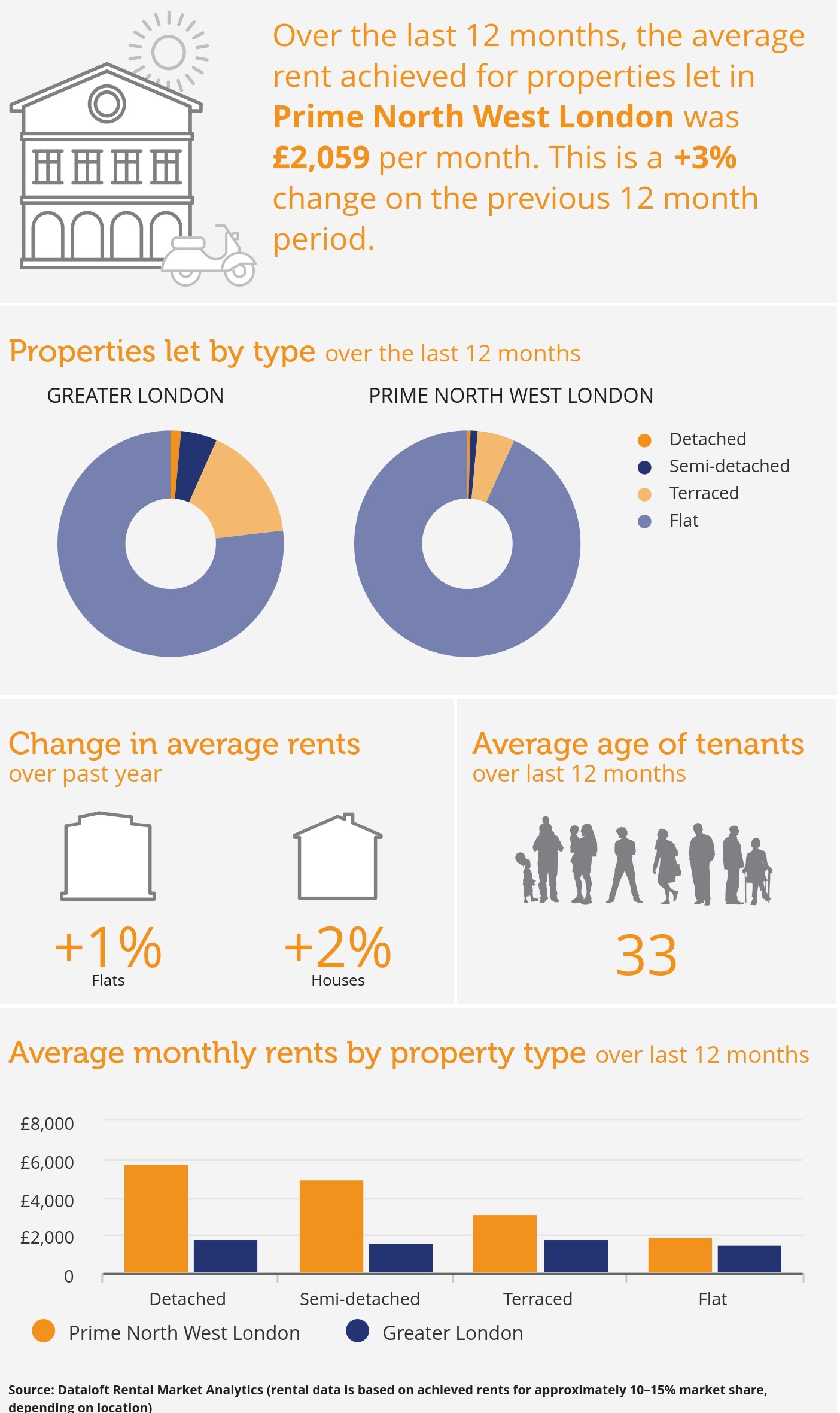

Prime North West London Lettings Overview

National Market

Rental market

The rate of annual rental growth across the UK remained unchanged in December at 1.4% (ONS). A shortage of supply and continued demand continues to underpin prices. Hometrack report a 4% reduction in rental supply across the UK since 2017, while demand has increased 8% over 2019.

York, Bristol, Nottingham are the current top three cities for rental growth according to the latest rental index produced by Hometrack. Rental values have increased by over 5% year-on-year. Leeds and Preston complete the top 5. At 2.8% rents are rising at their highest level for almost four years across the capital, which has seen a 19% reduction in available supply over the past two years.

Economy

At 76.3% the UK employment rate was at a record high in the three months to November, while wage growth continues to outpace rises in the cost of living. Adjusting for inflation, wages were 1.6% higher than a year ago (including bonuses) and 1.8% higher (excluding bonuses).

UK inflation unexpectedly fell to its lowest level in over 3 years in December. According to the ONS consumer prices rose just 1.3% in December, the smallest increase since November 2016. The fall is likely to fuel expectations that the Bank of England will cut interest rates which were held at 0.75% in November.